DOWNSIZING NOT DOWNGRADING

Downsizing before or after retirement?

Baby Boomers and early Gen X’ers, all those pre 1970, retirement is on your mind if not already happening or done. When we think of retirement, we think ‘not working full time’ or ‘not working at all’, we think travel, and adventures. Do we put much thought into our home?

These days when we think ‘downsize’ we don’t think of downgrading, we still want the luxuries that we have earned, the space, what we don’t want is the hard work of a huge garden or a two storey home.

If you sell the family home before you retire, are you absolutely sure of life post retirement?

You think you will travel but is that definite particularly if retirement is a few years away.

If you sell your beach house, what are the taxation issues or sell it after you retire, what are the impacts on your pension?

It’s currently school holidays in Melbourne and there are many grandparents baby sitting.

Do you mind the grandchildren in your home or their grandchilds?This may impact on your downsizing decision. One living room with your special things and active grandchildren could be a disaster – both of your things and your relationships.

If you have a courtyard space then is there anything for the grandchild to do or will you need to find a park?

Do you spend all the holidays out of your home, and in shopping centres, local parks, or particularly in Melbourne’s current weather (6 degrees, windy, raining where I live), getting from one venue to another?

One grandchild may want to do one thing, and the other something else. How indulgent of a grandparent will you be?

Retirement, and Downsizing Interstate

Moving to Queensland was a frequent exercise for the retirees of Melbourne, if not for the whole year, then as an alternative home to escape winter in the southern states.

Moving permanently to Queensland has become an issue since covid 19. Melbourne spent so much time in Lockdown, our economy suffered enormously with many small business going under, and larger ones not doing well either.

The government then brought in a raft of changes to the Residential Tenancies Act, Land Tax changes, and numerous other expenses that impacted dramatically on property investors. At a time where we have a housing shortage, this has exacerbated the problem as landlords exited Victoria for a ripening Queensland marketplace.

Accompanied by many other Victorians fleeing Melbourne metro for interstate or regional Vic, our economy was rapidly sinking. Victoria moved from being “the place to be” to “the place to flee”.

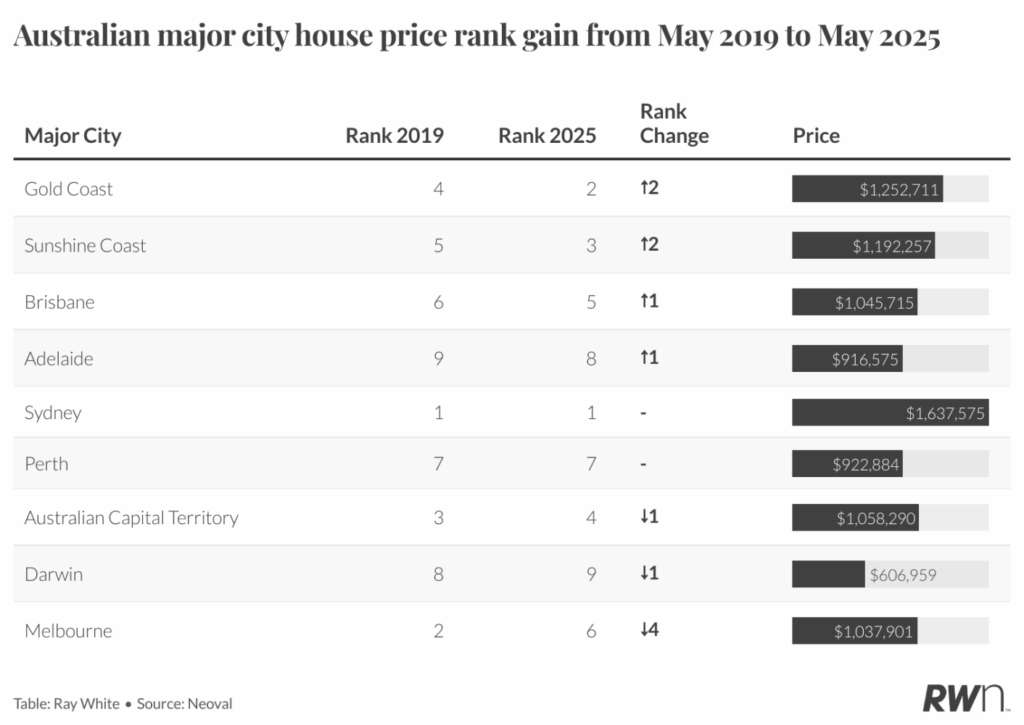

Recent findings by Ray White and reported on by economist Nerida Conisbee found that the ‘norm’ for decades of Melbourne being 2nd only to Sydney in the expensive home market had been overcome with Melbourne relegated to a dismal 6th place. Who benefited from our relegation? Yep, Queensland with 3 of the top 6 going to Queensland towns. It is cheaper to buy in Melbourne than the Gold Coast, the Sunshine Coast, and Brisbane.

If your retirement included a move to Queensland then you may need to rethink this. Selling in Victoria and buying the equivalent in Queensland may now mean that you need to take out a loan.

The only capital cities less expensive are in Tasmania. Perth, Adelaide or Darwin.

Downsizing After Retirement

Currently, your home is known as your Principal Place of Residence and is exempt from Capital Gains Tax.

If you sell after retirement then you will have to buy with the funds you have, and that may depend on the market at the time of sale. You really don’t want there to be a shortfall. Considering all aspects, all the costs of selling (real estate advocate, real estate agents fees, marketing, legal fees etc) and all of the costs of buying (your new home, stamp duty, legal fees etc) and talking it over with your financial strategist, accountant, and buyers advocate (me).

If you sell and there is sufficient excess to buy a new home and have plenty of cash left over then speaking to your financial strategist and accountant beforehand is a good idea. You will want to pay out any debt and have the excess working for you not against you by way of tax. Although you may not have to pay Capital Gains on the family home, it may count as taxable income depending on how it is handled. I am neither an accountant or financial strategist so take this as general advice only. A caution.

Downsizing not Downgrading

How do you envisage your new home? How many bedrooms, bathrooms, living spaces, garaging etc? Is it single storey or do you want views and a two storey is fine. Where are the shops and other facilities? How will you make friends to maintain your quality of life? If you buy in a wealthy area, can you afford to hang out with the wealthy ones on the golf course, dine out, travel etc?

Will you entertain in your home?

Will you baby sit grandchildren in your home?

Will downsizing provide you with the cash you need to retire comfortably?

Will your children come to visit you or will you need to travel to visit them?

There are a large number of questions to answer before you commit to anything.

When you are given advice, seek out the intention of the advisor, in whose favour are they advising?

Before you commit speak to your financial strategist, your accountant, and your advocate, their advice will be in your favour.